In retail, manufacturing and logistics there are no bigger rivals than Home Depot vs. Lowe's, GM vs. Ford, FedEx vs. UPS, respectively. We look at how these fierce competitors are exploiting IT to gain an advantage.

Credit: Thinkstock

IT Provides the Firepower

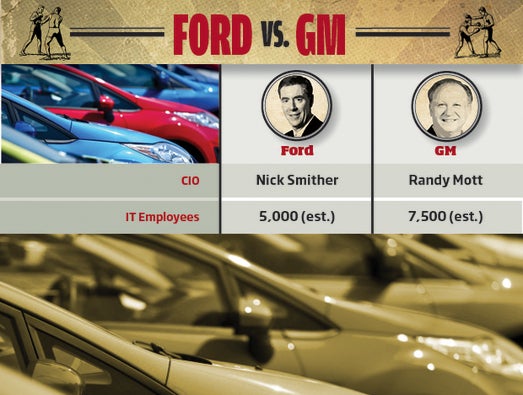

Ford vs. GM: IT Bragging Rights

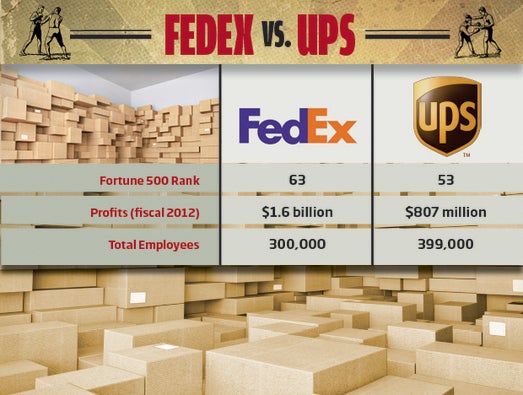

FedEx vs. UPS: The Business Challenges